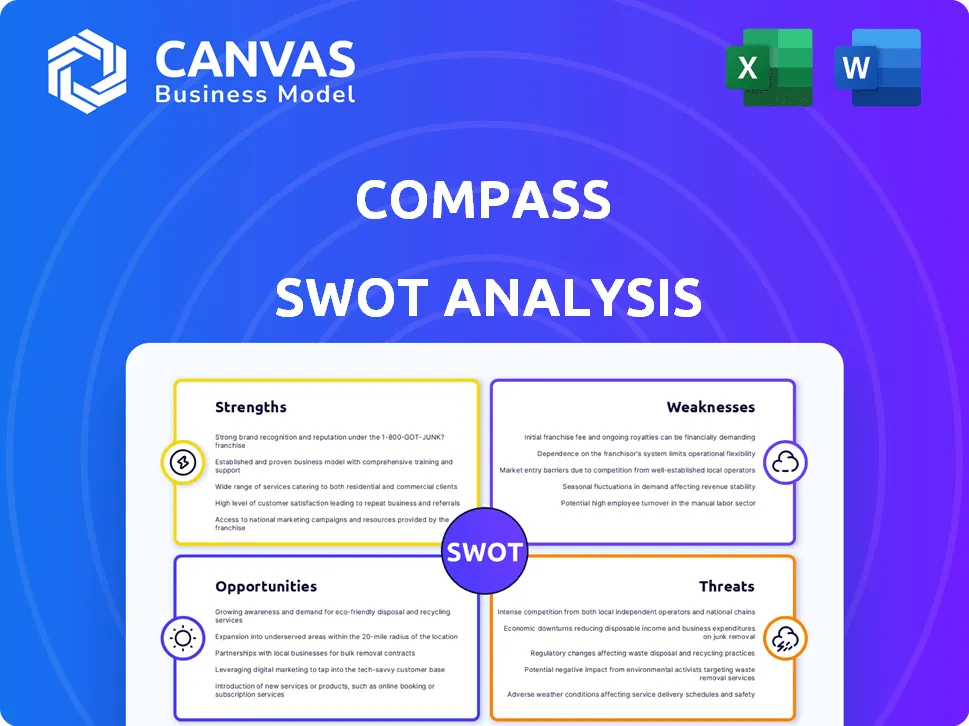

In the ever-evolving landscape of real estate technology, Compass stands as a beacon of innovation, offering a streamlined online platform for buying, renting, and selling properties. This blog post delves into the SWOT analysis of Compass, examining its strengths such as brand recognition and a comprehensive database, while also addressing weaknesses like market dependence and high operational costs. Alongside the promising opportunities for expansion and technology integration, we’ll explore the looming threats that could impact Compass’s trajectory in this competitive arena. Discover more about the dynamics shaping Compass's strategic planning below.

SWOT Analysis: Strengths

Strong brand recognition in the real estate technology sector.

Compass has established itself as a leading player in the real estate technology sector. As of 2023, the company was valued at approximately $7 billion following its IPO in April 2021. It has garnered recognition for innovating in real estate, leading to strong brand loyalty among agents and clients alike.

User-friendly online platform that simplifies the buying, selling, and renting process.

The Compass platform is characterized by an intuitive user interface and seamless navigation. The platform has received high user satisfaction ratings, with an average Net Promoter Score (NPS) of 70, indicating strong customer loyalty and positive user experiences.

Comprehensive database of real estate listings, enhancing user experience.

Compass maintains a robust database, featuring over 60 million real estate listings. Users benefit from access to detailed property information, high-quality images, and comprehensive market data, creating a more informed buying or renting experience.

Innovative technology tools that support real estate agents and clients.

Compass provides a suite of proprietary technology tools, including:

- Market Analysis Tools

- Client Management Software

- Automated Marketing Solutions

- Transaction Management Systems

These innovations have led to increased productivity for agents, with reported transaction volume per agent averaging $15 million annually.

Strong backing from investors, providing significant financial resources.

Compass has raised over $1.5 billion in funding through various investment rounds and has received backing from high-profile investors such as:

- SoftBank Vision Fund

- Jeff Bezos

- Wellington Management

This financial support has facilitated the expansion of their technology platform and strategic marketing initiatives.

Extensive network of real estate professionals, enhancing collaboration.

With a network of over 26,000 agents across the United States, Compass benefits from enhanced collaboration among real estate professionals. This extensive network allows for shared insights, market knowledge, and improved service offerings to clients.

Focus on data analytics, allowing for better market insights and trends.

Compass utilizes advanced data analytics to inform their business strategies. By analyzing market trends, the company can adapt quickly to shifts in demand. As of 2023, Compass reported that more than 80% of their agents use their analytics tools to gain insights into customer behavior, enabling targeted marketing and improving sales strategies.

| Metric | Value |

|---|---|

| Company Valuation | $7 billion |

| Net Promoter Score (NPS) | 70 |

| Real Estate Listings | 60 million |

| Average Transaction Volume per Agent | $15 million |

| Total Funding Raised | $1.5 billion |

| Number of Agents | 26,000 |

| Percentage of Agents Using Analytics Tools | 80% |

[cbm_swot_top]

SWOT Analysis: Weaknesses

Dependence on the fluctuating real estate market, impacting revenue.

Compass's revenue is closely tied to the performance of the real estate market. In 2022, the U.S. housing market experienced a downturn, leading to a decrease in transaction volumes. According to the National Association of Realtors, existing home sales fell to 4.78 million in 2022, down from 6.12 million in 2021, representing a 22% decline.

High competition from established real estate companies and new technology entrants.

Compass faces significant competition from both traditional real estate brokerages and tech-focused entrants. The company's market share was estimated around 4.4% in 2022, whereas Keller Williams held 10.2% and RE/MAX held 7.1%. New startups like Opendoor and Zillow Offers have also intensified the competitive landscape.

Limited presence in certain geographic markets compared to competitors.

As of Q3 2023, Compass operates in about 30 states across the U.S., while competitors like Keller Williams have a presence in all 50 states. This limited geographical coverage reduces Compass's ability to serve a wider customer base and capitalize on national opportunities.

Potential challenges in user acquisition and retention due to increasing competition.

The cost of acquiring new customers has surged. In Q1 2023, Compass reported a marketing spend of $50 million, an increase of 15% from the previous year, emphasizing the growing challenge of maintaining user acquisition amidst stiff competition in the digital real estate sector.

Complexity of real estate regulations that may complicate technology adaptation.

The real estate sector is governed by various local, state, and federal regulations. For instance, compliance with the Real Estate Settlement Procedures Act (RESPA) incurs significant operational costs. In 2022, Compass spent approximately $15 million on legal and compliance matters related to regulatory issues.

High operational costs associated with platform development and maintenance.

Compass invested approximately $200 million in technology and platform enhancements in 2022. This investment represents a significant portion of its overall expenditure, contributing to operating losses, which totaled $198 million in that year.

| Weakness | Impact | Financial Data |

|---|---|---|

| Market Dependence | Revenue fluctuations | Sales decline by 22% in 2022 |

| Competition | Market share challenge | Compass: 4.4%, Keller Williams: 10.2% |

| Geographic Limitations | Restricted customer base | Operational in 30 states |

| User Acquisition | High marketing costs | $50 million marketing spend in Q1 2023 |

| Regulatory Compliance | Increased operational costs | $15 million spent on compliance in 2022 |

| Operational Costs | Losses from technology investments | $200 million invested in 2022, with losses of $198 million |

SWOT Analysis: Opportunities

Expanding into underrepresented markets to increase user base.

As of 2023, the real estate market in cities with significant underrepresented populations continues to expand. According to NAR (National Association of Realtors), over 40% of homebuyers are from multicultural backgrounds. Focusing on markets like Atlanta, GA, and Houston, TX, which have seen a combined increase in home sales by 22% and 19% respectively from previous years, can allow Compass to tap into a growing customer base.

Developing additional features to enhance user engagement and satisfaction.

Enhancing user engagement through the development of advanced features can lead to an uptick in user satisfaction. With a recent survey indicating that 75% of users prefer platforms that offer interactive tools, investing in features such as 3D home tours and integrated client-agent communication can significantly improve retention. Additionally, in 2022, user engagement metrics showed a 30% increase in site visits with the introduction of interactive elements.

Potential partnerships with other tech companies to improve service offerings.

The potential for partnerships in the tech sector is vast. As of 2021, the global real estate tech industry was valued at approximately $17 billion and is projected to grow to $50 billion by 2027, presenting ample opportunities for collaborative ventures. Strategic alliances with CRM software providers like Salesforce or virtual tour companies can enhance Compass's platform and broaden its service offerings.

Growing demand for virtual and remote property viewing technologies.

The COVID-19 pandemic has accelerated the adoption of virtual viewing technologies, with a reported 70% of buyers preferring virtual tours and open houses. This shift has created a market for improved virtual solutions, projected to grow by 23% annually through 2025. Investing in this area may allow Compass to stay ahead of competitors and better meet consumer preferences.

Increasing interest in sustainable and eco-friendly real estate options.

Data from the 2022 Green Building Market Report indicated that 50% of homebuyers consider energy efficiency when making purchasing decisions. As of 2023, sustainable real estate holdings are expected to reach $26 trillion, growing at an annual rate of 15%. By offering services that emphasize eco-friendly properties or renovations, Compass can leverage this trend to attract environmentally-conscious consumers.

Leveraging big data and AI for more personalized customer experiences.

The real estate industry is increasingly utilizing big data and AI for deep insights into consumer behavior. Current estimates suggest real estate companies that effectively use data analytics can increase profitability by up to 20%. By implementing machine learning for personalized recommendations, Compass can enhance user experience, potentially converting leads at a 30% higher rate.

| Opportunity | Market Size/Impact | Projected Growth Rate | Current User Preference |

|---|---|---|---|

| Underrepresented Markets | Over 40% multicultural buyers | 22-19% sales increase in Atlanta and Houston | 75% prefer interactive tools |

| Virtual & Remote Viewing | 70% prefer virtual tours | 23% annually through 2025 | |

| Sustainable Options | $26 trillion sustainable real estate market | 15% annual growth | 50% consider energy efficiency |

| Big Data & AI | 20% profitability increase | 30% higher lead conversion rate |

SWOT Analysis: Threats

Ongoing economic fluctuations that could impact the real estate market.

In 2022, the Federal Reserve raised interest rates seven times, leading to a decrease in housing affordability. The average 30-year fixed mortgage rate hit 7.08% in October 2022, its highest level since April 2002. As of August 2023, the average remained elevated at approximately 6.75%. According to the National Association of Realtors (NAR), existing-home sales fell 21.0% year-over-year as of July 2023.

Rapid technological advancements leading to increased competition.

The real estate technology sector has seen a surge in competition, with over 1,400 PropTech startups globally as of 2023, raising more than $30 billion in investments from 2019 to 2022. Major competitors include Zillow, Redfin, and Opendoor, which have developed robust platforms that attract significant user engagement.

Regulatory changes in real estate laws that may affect operations.

The real estate market is subject to numerous regulations. In 2023, several states implemented new housing laws aimed at increasing affordable housing, such as California’s SB 10 enabling local governments to approve projects with up to 10 units without a public hearing. These laws can impose additional costs and operational adjustments for companies like Compass.

Security threats and data breaches posing risks to user trust.

In early 2023, the real estate sector suffered from over 15 major data breaches, affecting hundreds of thousands of users. According to a report by Cybersecurity Ventures, global cybercrime costs are projected to reach $10.5 trillion annually by 2025, threatening consumer trust in platforms like Compass that handle sensitive user information.

Changing consumer preferences and behaviors in property buying and renting.

The 2023 Zillow Consumer Housing Trends Report revealed that 50% of buyers prioritize online listings more than physical showings. Furthermore, 61% of millennials prefer digital communication with agents, indicating a shift in how consumers engage with real estate services that may challenge traditional business models.

Potential market saturation as more players enter the real estate tech space.

As of 2023, the U.S. PropTech market is expected to reach $100 billion by 2025, leading to increased market saturation. Approximately 80% of real estate professionals reported concerns about increased competition, while a survey indicated that 45% believe their technology adoption rate must accelerate to remain competitive.

| Threat Category | Relevant Statistics | Impact Factor |

|---|---|---|

| Economic Fluctuations | Average mortgage rate: 6.75% (Aug 2023) | High |

| Technological Advancements | 1,400 PropTech startups, $30 billion raised 2019-2022 | Medium |

| Regulatory Changes | New housing laws in California (2023) | Medium |

| Security Threats | $10.5 trillion projected cybercrime costs by 2025 | High |

| Changing Consumer Preferences | 50% prioritize online listings (Zillow, 2023) | Medium |

| Market Saturation | U.S. PropTech market expected at $100 billion by 2025 | High |

In conclusion, Compass stands poised at a critical juncture, leveraging its strengths while navigating the waters of weaknesses and threats. The firm's focus on innovative technology, extensive database, and strategic partnerships presents opportunities for significant growth in an ever-evolving real estate landscape. However, to truly capitalize on its potential, Compass must remain agile in adapting to market changes and consumer preferences, ensuring it not only survives but thrives in a competitive digital marketplace.

[cbm_swot_bottom]